Why Invest In Real Estate in the Dominican Republic

Why Invest In Real Estate in the Dominican Republic

Foreign Investments:

You wouldn’t be the first person who decided to stay.

In fact, it’s difficult to visit the Dominican Republic without dreaming about living here. Whether it’s our tropical weather, warm and friendly people, safe environment, technological developments or tax incentives, many travelers have decided to make their stay in the Dominican Republic permanent.

Our first visitor, Christopher Columbus, proclaimed Hispaniola “…the most beautiful (country) that human eyes have ever seen.” So it’s no surprise that so many visitors choose to stay.

Many are fascinated by our magnificent unspoiled nature, lush green valleys, coconut palm-lined beaches and rich history and culture.

Thousands of our residents were once visitors with the dream of living in a beautiful Caribbean country.

They turned a dream into a reality why don’t you?

Then you should ask yourself Why Invest In Real Estate in the Dominican Republic

It’s no wonder with incentives such as Law 195-13, and its regulations, grants wide-ranging tax exemptions, for fifteen years, to qualifying new projects by local or international investors.

The projects and businesses that qualify for these incentives are: (a) hotels and resorts; (b) facilities for conventions, fairs, festivals, shows and concerts; (c) amusement parks, ecological parks, and theme parks; (d) aquariums, restaurants, golf courses, sports facilities, and any other tourist facility; (e) port infrastructure for tourism, such as recreational ports and seaports; (f) utility infrastructure for the tourist industry such as aqueducts, treatment plants, environmental cleaning, and garbage and solid waste removal; (g) businesses engaged in the promotion of cruises with local ports of call; and (h) small and medium-sized tourism-related businesses such as shops or facilities for handicrafts, ornamental plants, tropical fish, and endemic reptiles.

Why Invest In Real Estate in the Dominican Republic

As for existing projects, hotels and resort-related investments that are five years or older are granted 100% exemptions from taxes and duties related to the acquisition of the equipment, materials and furnishings needed to renovate their premises. In addition, hotels and resort-related investments that are fifteen years or older will receive the same benefits as a new project if the renovation or reconstruction involves 50% or more of the premises.

Finally, individuals and companies get an income tax deduction for investing up to 20% of their annual profits in an approved tourist project.

Why Invest In Real Estate in the Dominican Republic

The Tourism Promotion Council, known by its Spanish acronym of CONFOTOUR, is the government agency in charge of reviewing and approving applications by investors for these exemptions, and, generally, of supervising and enforcing all applicable regulations. Once CONFOTOUR approves an application, the investor benefitting from the incentives must start and continue work in the authorized project within a three-year period to avoid losing all benefits under the program.

This basically means that both the developers and the buyers of property are entitled to tax savings.

The developers save on the 18% sales tax and Income tax

These can save buyers the 3% purchase tax and the 1% annual property tax

Why Invest In Real Estate in the Dominican Republic

If you want to move to the Dominican Republic and establish your business or company.

visit the Export and Investment Center of the Dominican Republic, CEI-RD: and also the National Council of Competition Website:SEE LINK HERE

Countries with the best commercial exchange relationships with the Dominican Republic can even work with Dominican Chambers of Commerce to develop their business.

If you have a monthly pension, you can use Law 171-07 on Special Incentives for Pensioners and Persons of Independent Means from foreign sources. This Dominican Law guarantees tax-free receipt of pension income, including the possibility of moving your belongings over; which even includes your car.

Why Invest In Real Estate in the Dominican Republic

There are many other benefits as well:

– Receive 50 percent Exemption on property tax.

– Exemption of taxes on the payment of dividends and interests, generated within the country or overseas.

– Receive 50 percent Exemption on taxes on mortgages, when the creditors are financial institutions that are regulated by Dominican financial monetary law.

– Exemption on the payment of taxes for household and personal items.

– Exemption from taxes on property transfers.

– Partial exemption on vehicle taxes.

– 50 percent Exemption of taxes on capital earnings, as long as the person receiving the income is the majority shareholder of the company and that the company is not involved in commercial or industrial activities.

– You must be able to obtain permanent residence within 45 days.

Why Invest In Real Estate in the Dominican Republic

The Dominican Republic strategic location situated in the heart of the Caribbean, converts it as a convenient point of access to markets in the global business.

It gives the country the potential of becoming a hub for trade and investment as well as a logistical centre for the large transatlantic ships.

The country has a highly developed system of industrial free zones, efficient networks for shipping and distribution channels and one of the most advanced telecommunications systems in Latin America. It has an efficient transportation network, enabling expeditious and reliable cargo shipment and travel, excellent road systems, nine international airports (with over 70 flights daily to and from the United States and Europe), several domestic terminals in important trade locations and twelve modern shipping ports, including the Multimodal Caucedo Port, which is BASC certified.

Why Invest In Real Estate in the Dominican Republic

The Dominican Republic offers a high standard of living. It should be mention, as a key factor in the investment industry development, that the country is highly competitive in terms of costs, experienced and qualified human resources, economical and political stability, open market access with the benefits of Free Trade Agreements with United States, European Union and the CARIFORUM countries. Also, the Dominican Republic offers special tax and import duty treatment, which present a broad variety of incentive and benefits in order to develop opportunities for business in the country.

Why Invest In Real Estate in the Dominican Republic

The facts to think over:

Stable economic and political environment

• FDI Friendly environment – Open Market

• Sound legal framework for foreign investment

• One (1) of Six (6) to hold Trade Treaty with EC and USA Five (5) Trade Treaties (DR-CAFTA,EPA, ALC RD –CARICOM, ALC –RD Central America, AAP – RD PANAMA)

• Competitive, qualified/Trainable labor force

• Modern transportation infrastructure

• Advanced and reliable telecommunication infrastructure

• Supporting Industries & services, Competitive costs for doing business

• Near Shore location

• Quality Life Standards

• Flexible Rules of Origin

Why Invest In Real Estate in the Dominican Republic

Economical and Political Stability:

Over the last decades the country has experienced consistent robust economic growth and stability – fruits of the government’s constant effort to ensure development and promote investment in the country’s markets.

Sound Legal Framework:

The country has an open and commercially integrated economy, which is supported by a developed legal framework that promotes economic stability and security for market participants.

The term foreign investment has been broadly defined to include traditional capital, registered trademarks in technology and other fields and financial instruments. The investment legal framework sets forth the principles of equal treatment allowing foreign investors to benefit from access to business opportunities in any sector of the national economy Real Estate in the Dominican Republic

Market Access:

An open trade agenda has given the country access to approximately 878 million consumers worldwide. The country is a founding member of the World Trade Organization and has entered into many free trade agreements with its trading partners – including the Dominican Republic-Central America Free Trade Agreement with the United States (DR-CAFTA) and the Economic Partnership Agreement with the European Union and the CARIFORUM countries.

Why Invest In Real Estate in the Dominican Republic

Investment Opportunities:

The main opportunities for business development in the Dominican Republic are within the sectors of telecommunications, infrastructure, renewable energy, agribusiness, call/contact centres, software development, manufacturing and tourism.

There is an extensive network of industrial free zone parks which houses more than 600 international companies, all of which operate under a tax-free regime and special customs treatment. The Santo Domingo Cyberpark specializes in Information Technology related to different industries, including software development and computer design and manufactured technology products.

These Zones offer Investors and companies a secure and sound platform in the Dominican Republic

Why Invest In Real Estate in the Dominican Republic

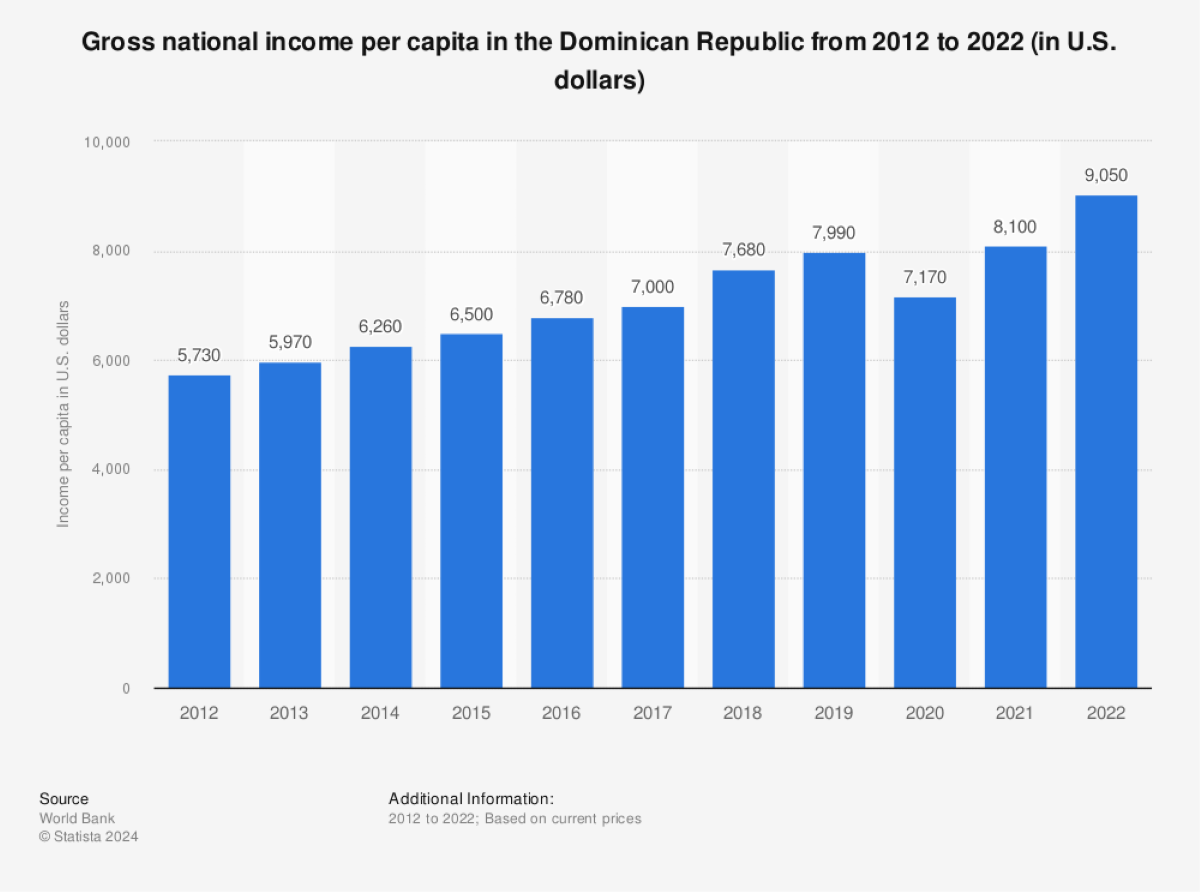

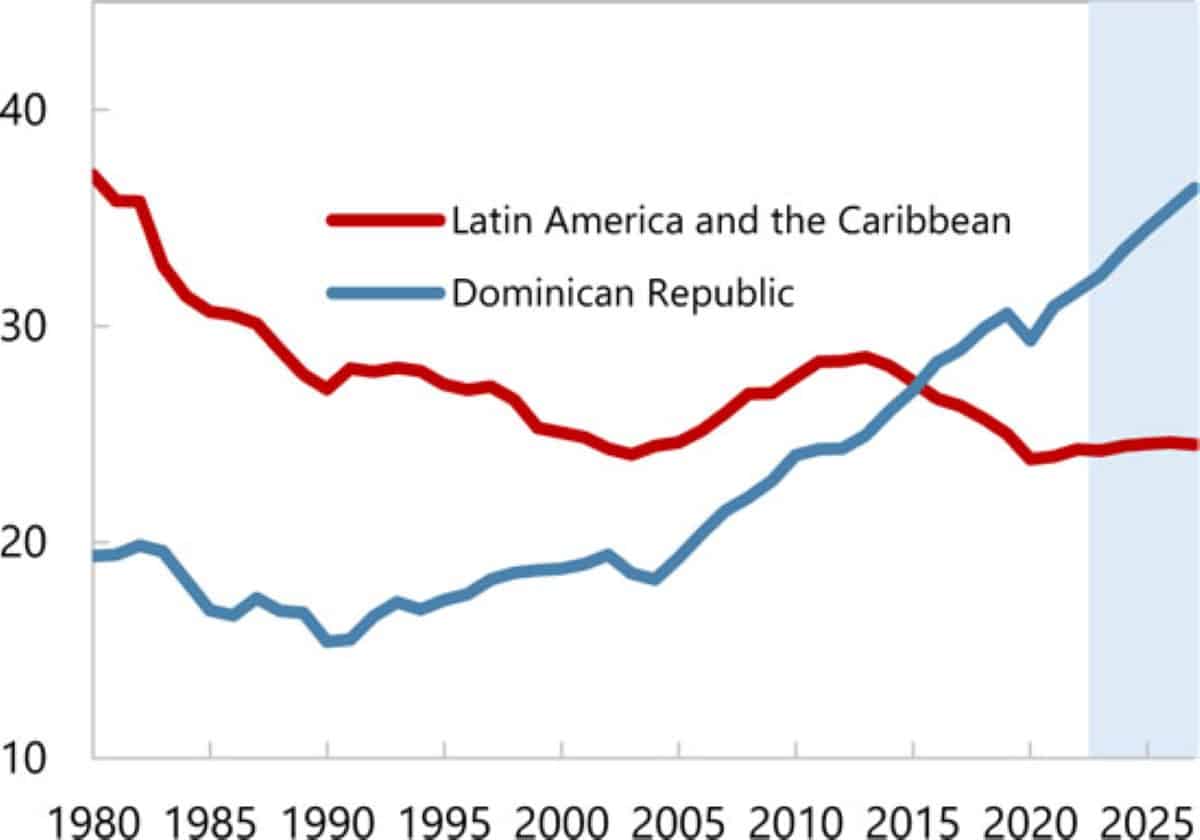

Dominican Republic Economic Indicators

Over the last two decades, the Dominican Republic has been one of the fastest-growing economies in the region. This was due to a combination of market-oriented structural reforms in the early 1990s and favorable external conditions that supported economic growth. In addition, prudent monetary and fiscal policy contributed to macroeconomic stability.

However, the drivers of this exceptional growth are reaching their limit due to low productivity growth in recent years, insufficient human capital to meet the needs of the business sector, the occurrence of climate change-related disasters, and distortions in key markets, including the inefficient allocation of tax exemptions.

The economy grew by 2.5 percent in 2003, and growth of 5.1 percent is expected for 2024, driven by the delayed effects of monetary policy easing and an increase in public investment. The upper-middle-income poverty rate (US$6.85 PPP per day in 2017 currency) is estimated at 19 percent, down from 20 percent observed in 2019, before the pandemic.

Why Invest In Real Estate in the Dominican Republic

Despite growth, several sectors have failed to generate quality jobs, and the high inflation rates observed in 2022 and 2023 (8.8 and 4.8 percent, respectively) affected the livelihoods of the population, mainly the most vulnerable. Consequently, it is necessary to improve access to quality basic goods and services—in education, health, water, and electricity—that help expand economic opportunities, increase economic mobility, and protect vulnerable sectors.

The Government has shown a strong commitment to addressing the long-standing challenges posed by the electricity sector through a comprehensive package of reforms, but challenges remain such as increasing transparency, accountability, and efficiency in the sector; continuing with the diversification of the energy matrix, including less polluting energy sources; and increasing access to reliable and affordable energy. Improving the environment to support the competitive development of private sector-led renewable energy investments will also be key.

Why Invest In Real Estate in the Dominican Republic

More than 40 percent of Dominicans live in vulnerable conditions and are at risk of falling into poverty due to climate-related impacts and economic crises. Likewise, gender gaps in jobs and wages, shorter working lives, and higher unemployment and unpaid roles contribute to a higher incidence of poverty among women.

Climate change has intensified exposure to natural disasters, which could increase contingent fiscal liabilities, given the country’s low degree of financial protection against these risks. The occurrence of adverse events increasingly highlights the critical need for accelerated action to strengthen the country’s resilience and adaptation in an inclusive manner.

Looking ahead and to achieve inclusive growth, the Dominican Republic will require a greater increase in productivity, through the implementation of reforms to strengthen fiscal reserves, human capital, competitiveness, innovation, green technology, public spending efficiency, and resilience to climate events. These changes should go hand in hand with improvements in labor market regulations and social protection systems.